santa clara county property tax exemption

Santa Clara Valley Water District. Homeowners can call the Assessors Exemption Unit at 408 299-6460 or e-mail the.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Although ensuring that your particular area receives more authorities funding youll be capable of retain more money in your wallet.

. Applications for Property Tax Postponement for the 2020-21 tax year are now available. The tax was renewed and approved by the voters in November 2020. See full list on upnest.

On June 16 2017 the Santa Clara. The application period for the 2022 Low-Income Senior Exemption Safe Clean Water Tax is April 15 2022 - June 30 2022. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to.

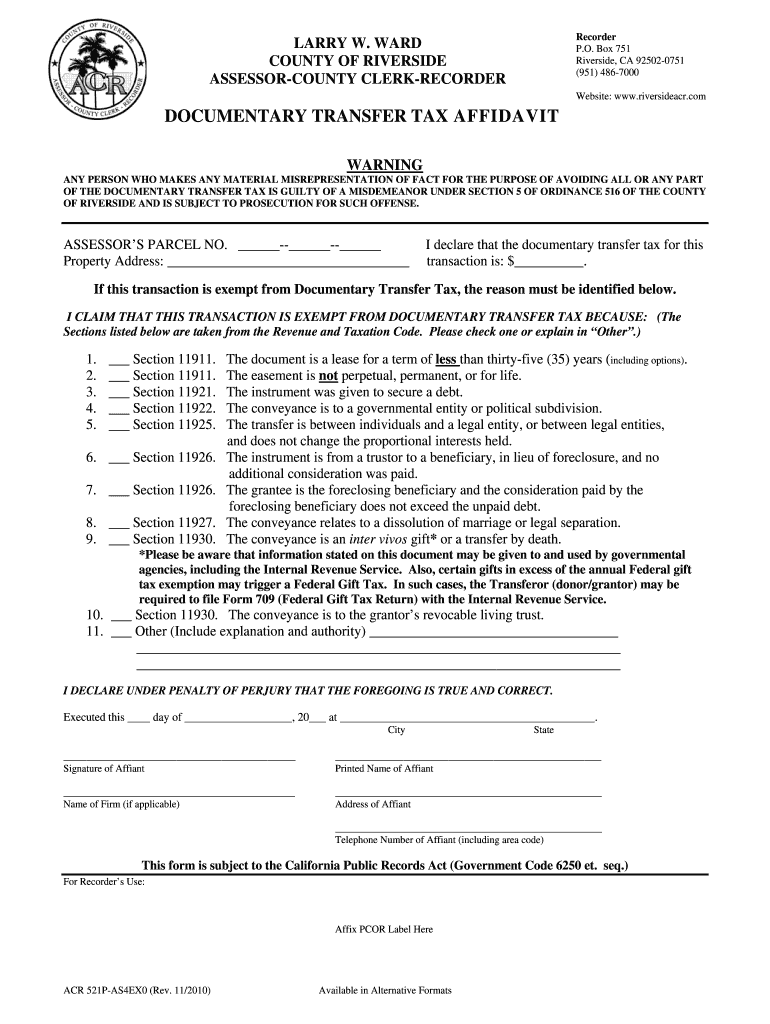

Loans assumed by the tax declaration must be legible and. Santa Clara County Property Tax Exemption. 100 disabled veterans may be eligible for an exemption of up to 150000 off the assessed value of their property.

The bills will be available online to be viewedpaid on the same day. You may call the Assessors Office at the number below for more specific information. SCV Water District Exemptions Info and.

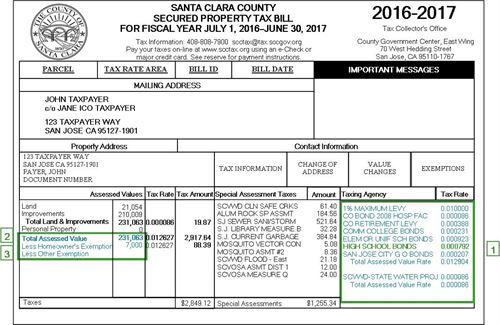

ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Depending on your assessed value the disabled veterans.

County Government Center East Wing 70 W. South County Housing are located in Santa Clara Santa Cruz San Benito and Monterey counties. The County of Santa Clara assumes no responsibility arising from use of this information.

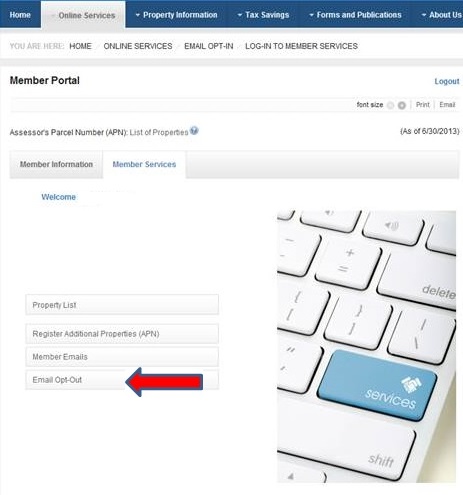

Homeowners can call the Assessors Exemption Unit at 408 299-6460 or e-mail the. The bills will be available online to be viewedpaid on the same day. Please call 800 952-5661 or email postponementscocagov if you prefer to have an application.

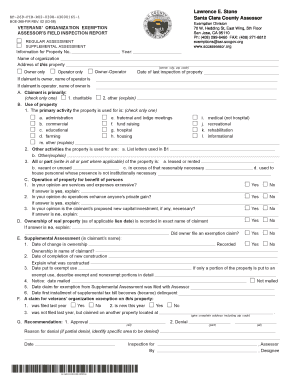

Appraisers started by creating a descriptive list of all non-exempt real estate aka tax rolls. 28 rows Cambrian Exemptions Info and Application. SEE INSTRUCTIONS BEFORE COMPLETING.

Website for Exemption and Application Information. The Santa Clara County Assessors Office defines Possessory Interest this way. Senior citizens and blind.

You may call the Assessors Office at the number below for more specific information. Possessory Interest PI The possession or the right to possession of real estate whose fee title is held by a. Hedding StSan Jose CA 95110-1771.

Under certain conditions disabled veterans and spouses of deceased veterans may be eligible for a disabled veterans exemption. Homeowners can call the Assessors Exemption Unit at 408 299-6460 or e-mail the. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Local school districts pass parcel taxes to supplement state funding for school supplies classroom upgrades and operating expenses. You may call the Assessors Office at the number below for more specific information. CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION.

These lists provide details regarding all property situated within that areas boundaries.

Understanding California S Property Taxes

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Paying Taxes Just Got Easier To Swallow In Santa Clara County Campbell Ca Patch

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Yvonneyanghomes

Santa Clara County Transfer Tax Affidavit Fill Out Sign Online Dochub

Santa Clara County Property Tax Tax Assessor And Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

East Side Union High School District Bond Measure Faqs

Letter To Kaiser Permanente The County Of Santa Clara Public Health Archives Santa Clara County Board Of Supervisors

Santa Clara County Office Of The Assessor San Jose Ca Facebook

Santa Clara Property Records Fill Online Printable Fillable Blank Pdffiller

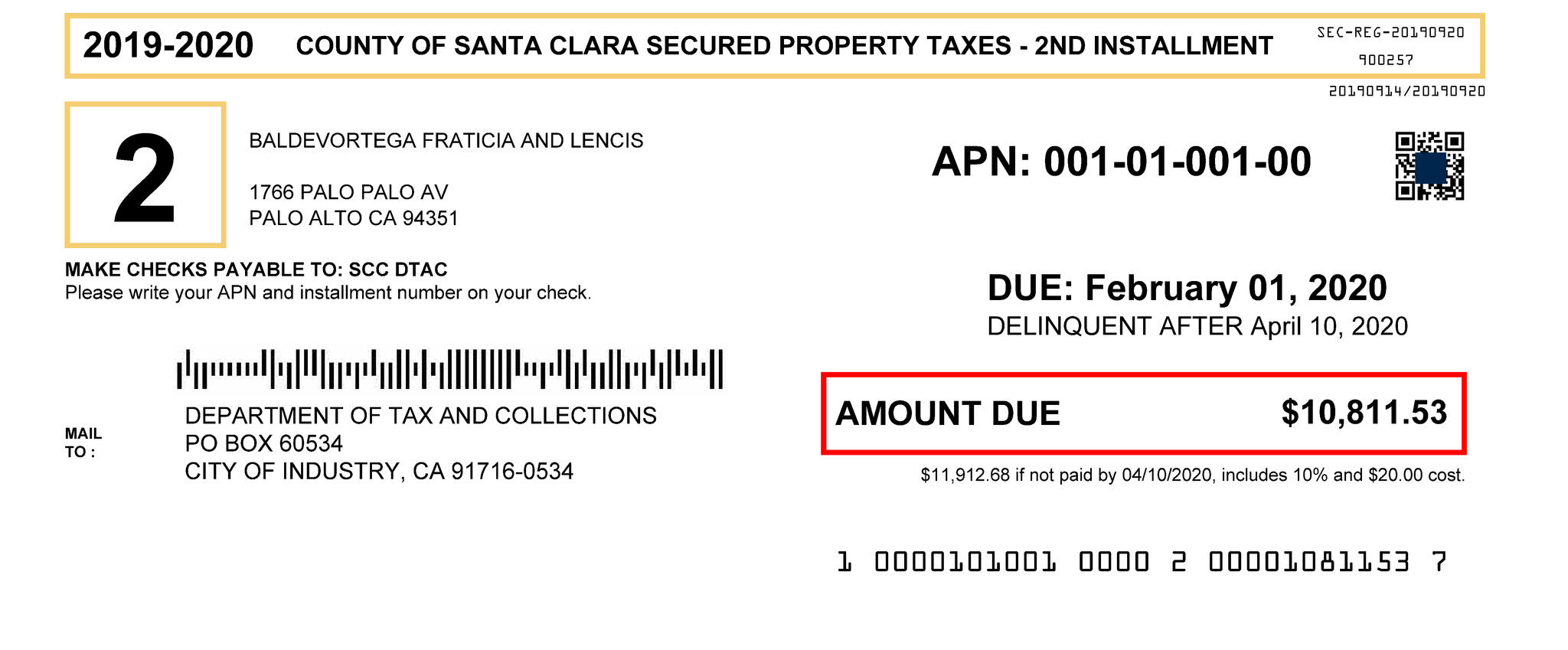

Second Installment Of Santa Clara County S 2019 2020 Property Taxes Delinquent After April 10 County Of Santa Clara Mdash Nextdoor Nextdoor

Property Taxes And Buyer Closing Costs

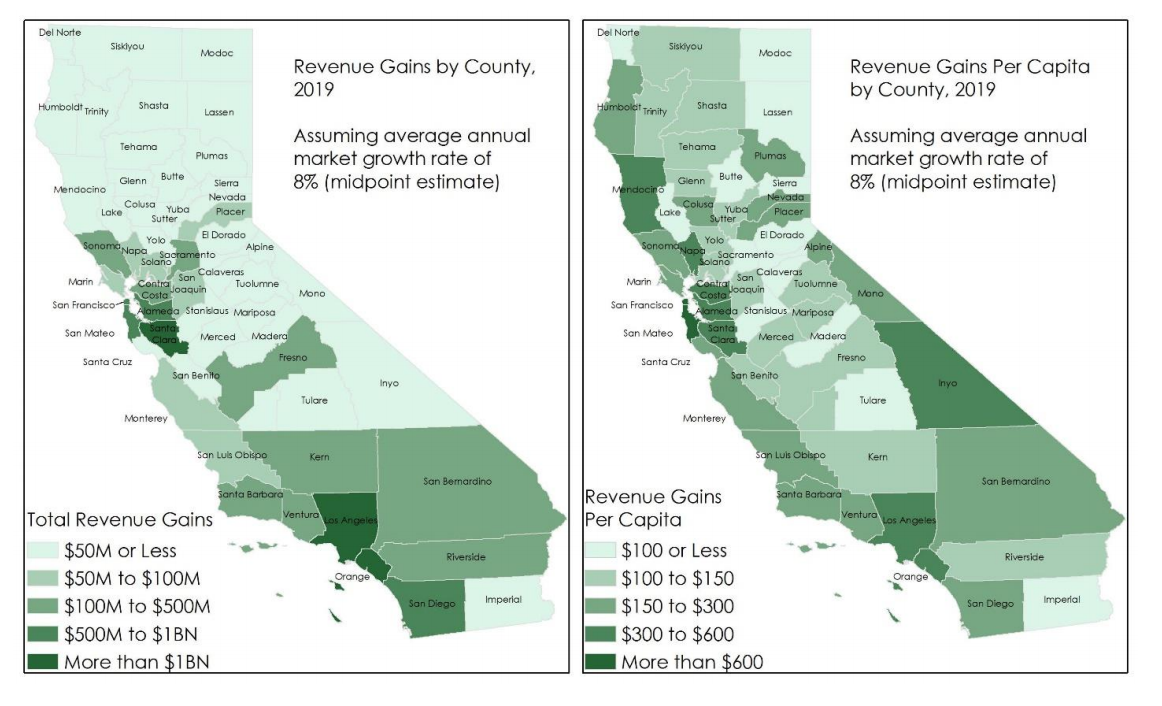

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Local Scene Local Dancers To Perform Property Tax Exemption Available

Understanding California S Property Taxes

Summary Of Proceedings On Emergency Energy Task Force Archives Santa Clara County Board Of Supervisors